A view across Asia and how to capitalise on complex market conditions

By: Shakunt Malhotra, Managing Director, Asia

Firstly, I sincerely hope that everyone is as safe and well as possible. It’s an extremely difficult time for everyone at the moment. Our first thoughts are, of course, about everyone’s wellbeing. We’re also very aware of our commercial responsibilities to our customers and their ongoing business requirements. We have clearly communicated our current ability to service all needs and we will continue to do so.

I thought this was a good time to step back a little and explore the current state of the media and entertainment sector across the region in my role as MD in Asia, which I started towards the end of last year. But I am hardly new to Globecast, as many of you know, having been with the company for almost 20 years.

A snapshot of the Asian market

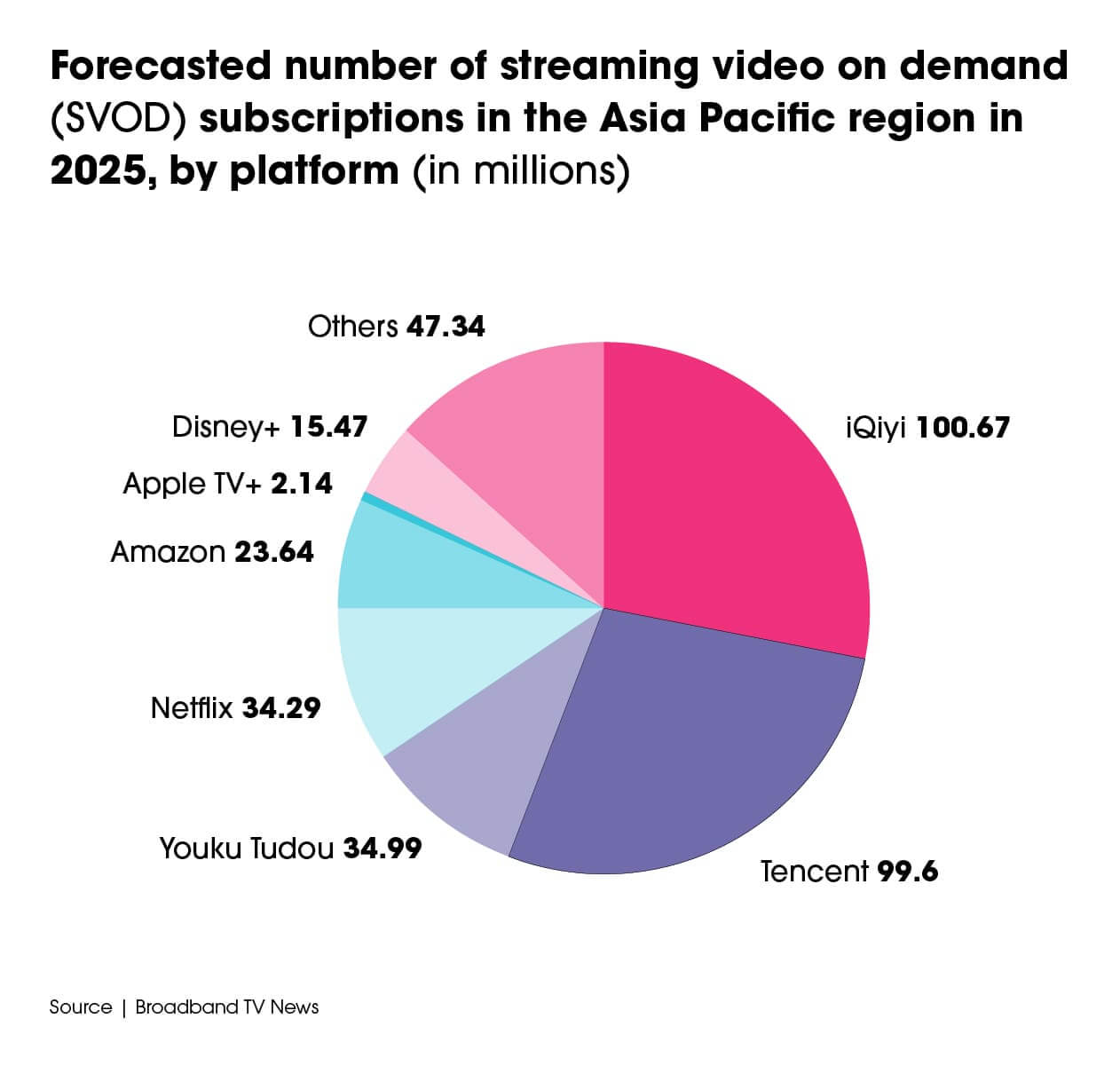

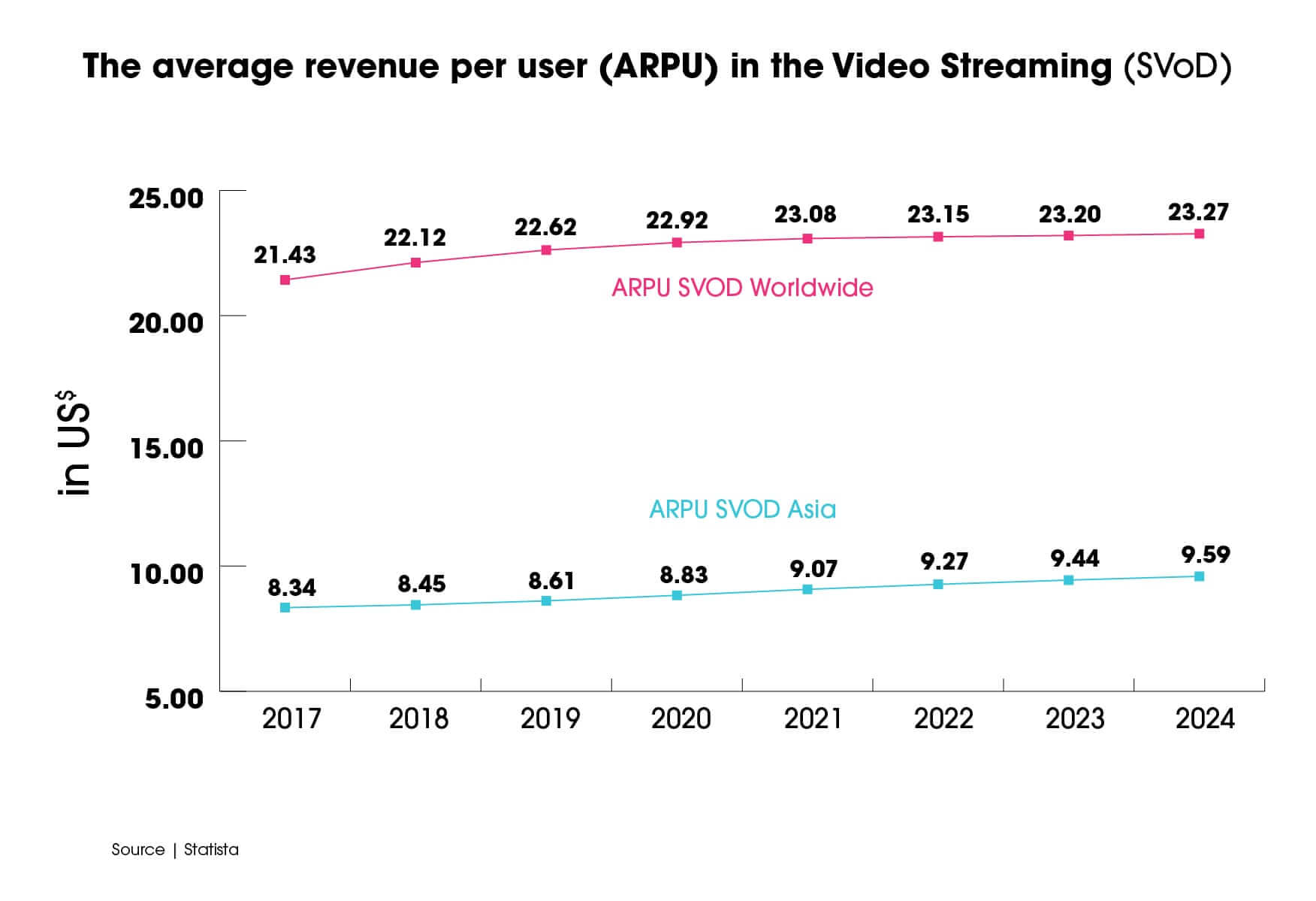

As with the rest of the world, 2020 is very much about streaming and the battles being fought across Asia. Direct-to-consumer, including global players like Netflix, is undoubtedly challenging local pay-TV operators to restructure their business models and become more flexible. Regional players like Iflix (Malaysia based) are battling hard while other local players, like HotStar in India, are popular but there are issues around ARPU. Cash crunch is very apparent with the recent announcement of the liquidation of Singapore-based regional OTT player, HOOQ, by SingTel.

Looking more broadly at OTT video, the market across Asia is really a mixed bag and because of this it requires service flexibility from media service suppliers like us. There are mature markets like China, India, Japan, Korea and Singapore where OTT services have gained a lot of traction. Others are quickly catching up as their broadband infrastructure improves. OTT has strong potential, and the cost of entry is low, especially as the number of broadband subscribers overtakes the number of TV households. However, again the issue is ARPU, which is generally very low and that’s a real challenge. A greater ability to identify high disposable income viewers would help drive the sale of more services.

Another (GREAT) article by SHAKUNT: 10 POWERFUL APPLICATIONS FOR AI IN BROADCAST

Free-to-air still a driver

Free-to-air TV is still a key driver across much of Asia, therefore brands continue to count on linear TV to create and grow awareness. Even for new OTT entrants, the quickest way to popularise content is often via a linear channel on satellite. OTT growth is also challenged by the availability of a lot of free content. Localisation of content with subscriber-based or ad-based models are key decision-making points for both pay-TV and OTT operators.

We see things in Asia trending toward the cloud and virtualisation for us and our customers, especially in terms of moving content: transmission-ready workflows in association with edge playout deployment accelerated last year. In some ways we may well be more advanced here than in other places, which is why we put such a strong focus on this within our service portfolio. Globecast is, of course, a global company and we’re highly connected across our Media Centres.

We’ve also been testing the applicability of AI in our workflows, case in point being our QC and local compliance services. AI is becoming more relevant in managing content and the creation of metadata.

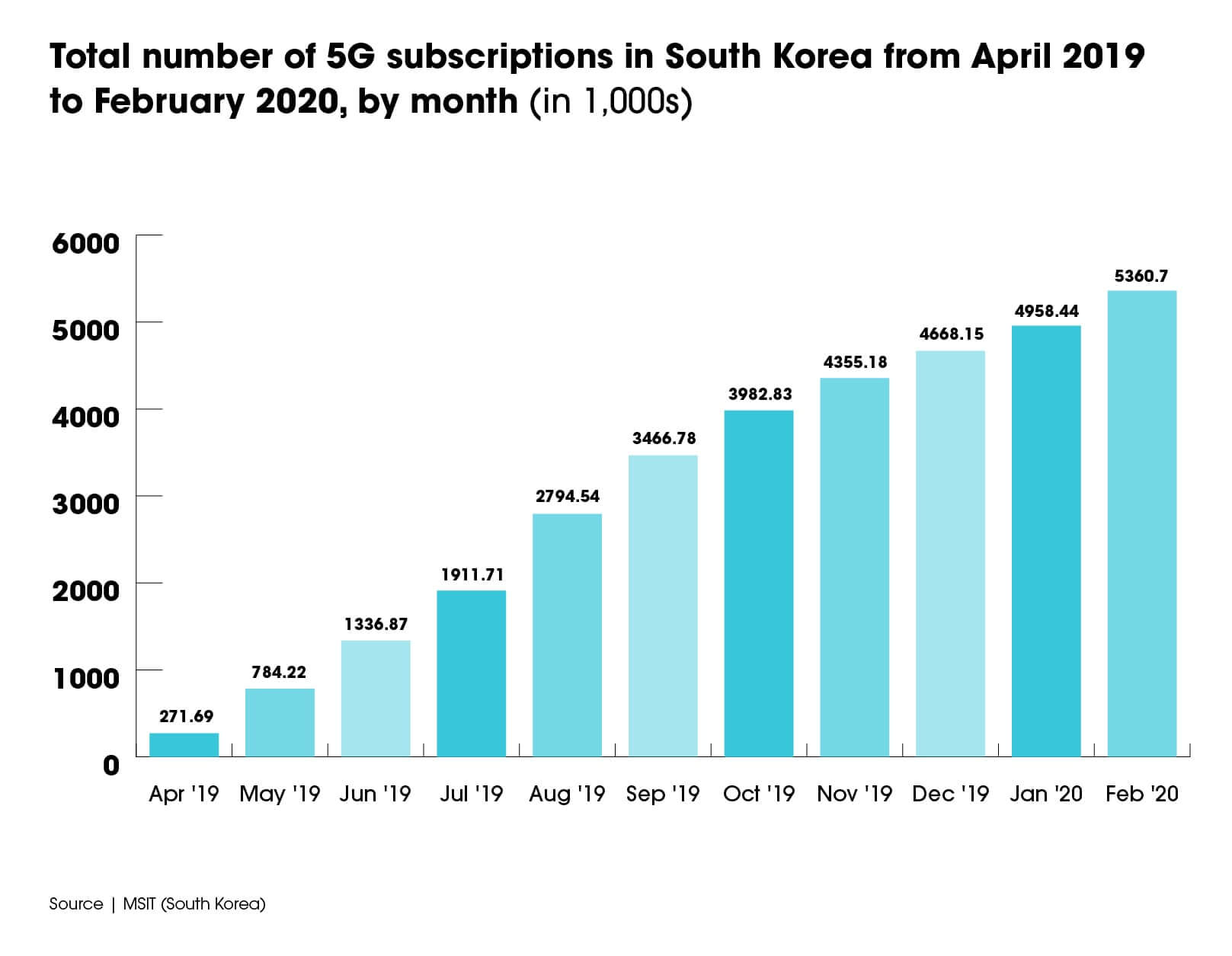

IP delivery using resilient protocols for point-to-point has been in the market for a long time. With the growing acceptance, this year it’ll be put into use more widely. We see great potential in point-to-multipoint delivery using edge computing, especially with the bandwidth squeeze expected from 5G. We’ve been testing 5G for contribution services, with a number of 5G trials in the region since spectrum redistribution has already started in some countries.

Media companies will also be testing a full range of 5G services like high-speed download and low latency streaming. We think the 5G space will be an interesting one to look at for features like low latency sports streaming with CMAF (Common Media Application Format) for synchronisation.

How can Globecast help you?

Globecast has always been proactive in new service offerings based on market needs. Our activities in Asia include contribution, media management, playout solutions and distribution/delivery. There’s our very significant sports and live events work including VOD content creation. We also have our CAAD (Content Acquisition, Aggregation and Delivery) service for channel rights/channel distribution and, of course, business continuity. There’s also our OTT TV Everywhere technology suite.

Our public internet content delivery service Globecast XN has been available for some time. Globecast Managed Cloud Network (Globecast MCN) is a complementary solution to Globecast XN for point-to multi-point delivery, offering a self-provisioning SDN (Software Defined Network) over cloud infrastructures. Globecast MCN is targeted at sports events/rights holders and streaming delivery but we’ve now exploring extending it for multi-point linear channel delivery.

We have a multi-channel playout platform with automation in the cloud and playout using servers at the edge for onward local distribution. The platform is centralised in London and Madrid and can be operated and monitored from our playout control room in Singapore. An advanced remote monitoring system enables proactive monitoring with audio-visual alarms.

Furthermore, major social media platforms have taken advantage of our streaming services across the globe to bring fresh, exciting content to their users with streaming part of our contribution service deliverables. For key sports events, we work from contribution through multiplatform distribution including streaming and on top of that we have our Digital Media Hub (DMH) modular suite of services. This facilitates cross-platform live content publishing (including to social media) and significantly increases content monetisation opportunities

Via DMH’s Content Marketplace module, transcoded content is made available for affiliates to download when they want. And our recently announced Infrastructure as Code capabilities we believe will drive cloud playout, and related services, to the next level.

A key target for me and the whole team is to leverage our global capabilities to achieve the best for both local and international customers. We will continue to combine our expertise across traditional technologies while using our agility and deep market understanding to explore and develop additional dynamic services.